Singapore Budget 2018: Bonuses for adults, wage increase co-funding, and more

A few days ago, Finance Minister Mr Heng Swee Keat delivered the Singapore Budget 2018. Against the backdrop of a shift in global economic weight towards Asia, the emergence of new technologies, and population aging, Budget 2018 sets out to support a:

- Vibrant and innovative economy

- Smart, green and liveable city

- Caring and cohesive society

- Fiscally sustainable and secure future

With this in mind, this week we discuss the most interesting developments from the Singapore Budget 2018 as it pertains to businesses and Singaporeans.

Adult Singaporeans get a bonus of up to SGD 300 each

Due to a surplus of almost SGD 10 billion from Budget 2017, SGD 7 million will be shared with all adult Singaporeans aged 21 and above in the form of a one-off bonus (or ‘hongbao’) based on assessable income. Around 2.7 million Singaporeans are expected to receive either a bonus of SGD 100, 200, or 300, depending on their income in 2017 (as shown in the table below):

| Assessable income | Bonus amount |

| Up to SGD 28,000 | SGD 300 |

| SGD 28,001 to 100,000 |

SGD 200 |

| Above SGD 100,000 | SGD 100 |

*Adults who own more than 1 property will receive a bonus of SGD 100

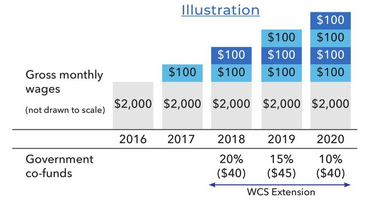

Extended support to co-fund wage increases

Another key highlight form the Singapore Budget 2018 is the extension of the Wage Credit Scheme, which supports businesses and employees by co-funding wage increases. For the 2017 financial year, more than SGD 800 million will be paid out to over 90,000 firms for wage increases that benefited 600,000 Singaporean employees with monthly wages of SGD 4,000 and below. Extended for three more years, the scheme will co-fund 20% of wage increases in 2018, 15% in 2019, and 10% in 2020. Rebates under the Corporate Income Tax scheme will also be raised, from 20% to 40% in 2018.

Source: Ministry of Finance’s Twitter page

Foreign worker levy rates deferred

The earlier announced increases in Foreign Worker Levy rates will be deferred for the marine shipyard and process sectors, which still face weaknesses. The levy rates for foreign workers in all other sectors will remain unchanged – SGD 300 for higher-skilled workers, and SGD 400 for lower-skilled workers.

New measures to promote innovation

Among the new measures outlined in the Singapore Budget 2018 include tax deductions to help companies build their own innovations. The deductions will be as follows:

- Intellectual property registration fees from 100% to 200% (capped at SGD 100,000 of licensing payments each year)

- Qualifying R&D expenses in Singapore, from 150% to 250%

The Singapore Budget 2018 also introduced a new Productivity Solutions Grant, which will provide funding support for around 70 percent of qualifying costs for SMEs looking to adopt off-the-shelf technologies.

10% tobacco excise tax

Effective from 18 February, 2018, a 10% excise tax on all tobacco products is now in force. Aimed at discouraging the consumption of tobacco, the excise duty is levied on all goods manufactured in, and imported into Singapore.

Increase in spending to better serve the needs of aging Singaporeans

As we discussed in our recent article on retiree health insurance, the rise in healthcare costs is expected to become an ever-increasing burden for older adults in Singapore – the highest utilizers of care. To better serve the needs of aging Singaporeans, the government also aims to spend SGD 550 million more to integrate its health and social services for seniors.

This means the Ministry of Social and Family Development’s social aged care functions under the Senior Cluster Network and other programs will be transferred to the Ministry of Health, which will enable services “to be planned and delivered holistically”, according to Minister Heng.

Other interesting developments

- Another SGD 220 million will be allocated yearly to education schemes, which help support students from lower- to middle-income families, as well as students in special education schools.

- The GST (goods and services tax) will be raised from 7% to 9% – the first time in more than a decade. To help lower-income households cope with the increase, SGD 2 billion will be added to the GST Voucher scheme.

- The top marginal Buyer’s Stamp Duty will increase from 3% to 4%, and applies to the proportion of residential property value in excess of SGD 1 million. Stamp duty rates for non-residential properties remain unchanged.

At the end of his Singapore Budget 2018 speech, Minister Heng concluded by saying: “Budget 2018 is about laying the foundation for our nation’s development in the next decade”.

Supporting health initiatives with private medical insurance for expats

The new initiatives announced in the Singapore Budget 2018 are great news for Singaporeans, however many expats will only benefit from a few of the actions. Where healthcare is concerned, foreigners can fill any gaps in subsidized care that their status restricts them from with comprehensive medical insurance for expats. As the broker of choice for 500,000 clients worldwide, Pacific Prime Singapore has years of experience matching expats and companies in Singapore with the best insurance solutions for their needs. For a free quote, contact us today!

- The Pros and Cons of the Singapore Healthcare System - February 27, 2023

- Social fitness: Why you should consider embracing it - February 6, 2023

- Singapore launches new M-SEP scheme allowing firms to hire more S-pass and work permit holders - January 26, 2023

Comments

Comments for this post are closed.