The insurance claims process: Your guide to health insurance billing in Singapore

We all know that health insurance provides reimbursement for costs related to medical services, but did you know that the insurance claims process can vary significantly? In fact, submitting a claim can be a tedious task, or happen in the blink of an eye depending on the support we have access to. To ensure that all of your future medical insurance claims go smoothly without any hiccups, read the following for in-depth insight on how insurance billing works in Singapore.

Insurance billing methods

If you’re a private medical insurance policyholder, you’ll likely have experience dealing with one or both of the below insurance billing methods:

- Direct billing: As a common feature in international health insurance plans, direct billing does not require the policyholder to pay up front. Instead, healthcare providers who are part of your plan’s direct billing network will settle your claim directly with the insurer. This insurance billing method boasts a whole host of benefits, including increased payment efficiency and patient satisfaction.

- Patient reimbursement: If the direct billing feature is absent from your policy, you’ll likely be required to pay your medical bill up front first, and then submit the receipts and associated claims forms to your insurer afterwards. This can be a tedious process, especially if you choose to do it alone, as opposed to engaging the help of a broker to streamline the reimbursement process.

What are the key steps in a typical insurance claims process?

Many find submitting claims a tedious task, but it doesn’t have to be this way. To focus on getting better without worrying about your medical bill, obtaining a plan with an extensive direct billing network, and/or engaging the help of a full-service broker, can be key in ensuring a hassle-free insurance claims process.

Here, we look at the key differences between settling a claim on your own vs. doing so with the help of a broker:

Handling insurance claims on your own

- Notify your insurer as soon as practicable; preferably before you seek treatment/book an appointment. (However, insurers will understand that this is not always possible). It’s important to ascertain what your claim time limits are, as some providers require claims to be submitted within a specific time frame from when care is sought. Otherwise, your claim can be rejected.

- Pay for your treatment, including any deductibles and/or co-pays. Get insurer approval for your treatment if necessary.

- Obtain all necessary documentation to submit your claim. This includes receipts from your care provider, prescription notes, a completed claims form, lists of medication administered, and maybe more (your insurer should detail what documents are required).

- Submit the documents to your insurer. Please note here that no decisions on reimbursements will be made until all necessary documents have been submitted. You can either mail your documents, drop them off at the insurer’s office in person, or submit online copies of all necessary documents via a dedicated e-portal/app (if applicable).

- Keep on top of your claim. Just because you have submitted all your documents doesn’t mean the insurance claims process is over. Claims processing times will differ between insurers; sometimes, it can take weeks. During this time, it’s important to check with your insurer to ensure that everything is progressing smoothly. Questions to ask can include: “When will my claim be processed?”, and “How will I be notified once it’s been processed?”.

After step 5, assuming all required documents have been submitted correctly, and that your treatment is covered by your health plan, you should receive reimbursement for your medical costs in the form of a check or direct deposit to your bank account.

Submitting a claim with the help of a broker

- Notify your insurer/broker as soon as practicable. Large brokers like Pacific Prime Singapore have dedicated in-house claims support teams. This additional point of contact can be valuable should you require additional assistance, or information on plan specifics.

- Pay for your treatment, including any deductibles and/or co-pays. Once you’ve been treated, your claim is now in the hands of your broker, who will liaise with the insurer on your behalf!

With the help of a full-service broker, claims submissions can be completely hassle-free, as brokers often work directly with insurers in order to facilitate the insurance claims process. Not only that, but brokers can offer a whole host of service additions at no extra cost vs. going direct to an insurance company.

At Pacific Prime Singapore, the additional services we offer include:

- Claims support

- Unbiased advice

- Comprehensive price quotes

- Plan comparisons

- Help with renewals

- Insurer liaison and negotiation

- Plan analysis

- Hospital information and recommendation

- Admin assistance

Why is my claim taking so long to process?

Unfortunately, the insurance claims process doesn’t always go smoothly, and people do sometimes experience delays. With this in mind, it’s a good idea to watch out for the most common reasons for hold-ups in claims processing:

- Incorrectly-filled claims forms

- Missing documentation

- Insurers may take some time to investigate further if your claim is for a pre-existing condition

- Complex situations/cases

Engaging the help of a broker can make the difference in ensuring that any delays are sorted as quickly as possible. Should your claim be rejected, we will always reach out to explain why and go through alternative options if they’re available.

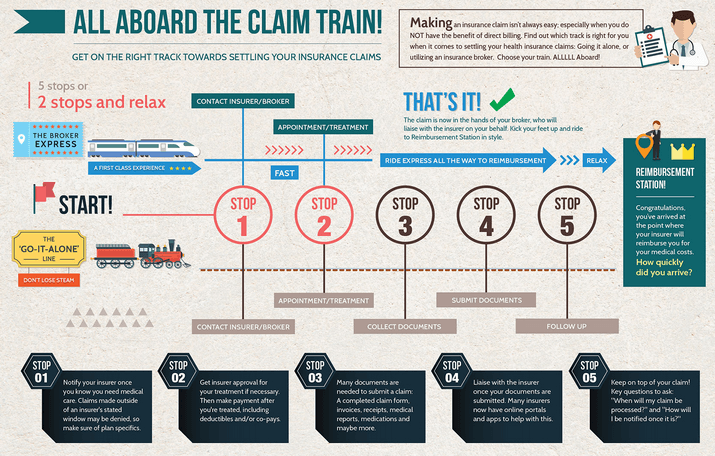

Have you heard about our ‘Claim Train’ infographic?

To learn more about the insurance claims process, be sure to check out ‘The Claim Train’ infographic featured on Pacific Prime’s website. By visually illustrating the key differences in submitting a claim on your own vs. with the help of a broker, the infographic can help you decide for yourself which claims submission method is best for you.

If you have any questions about the insurance claims process, direct billing, or any other specific aspects of your health insurance you should know about, contact our experts today. As Asia’s leading insurance broker, our experienced advisors are standing by to answer all your questions, offer impartial advice, and give you a free price quote and plan comparison.

- The Pros and Cons of the Singapore Healthcare System - February 27, 2023

- Social fitness: Why you should consider embracing it - February 6, 2023

- Singapore launches new M-SEP scheme allowing firms to hire more S-pass and work permit holders - January 26, 2023

Comments

Comments for this post are closed.