Guide: Comparing health insurance plans

When it comes to finding an health insurance plans in Singapore, it can almost feel like you’re trying to work your way through a labyrinth. First off, the Singapore insurance market spoils for choice every person that seeks to find a new insurance policy. There are quite a number of different insurance companies in the city. Additionally, even if you were to look at the offerings from a single insurance company, you are likely to find quite an array of plans and optional benefits that can further tweak them in order to address your specific needs. It can certainly be an ordeal to identify the ideal health insurance plan for you and your family, especially if you’re not familiar with all the different aspects of health insurance that you should be aware of.

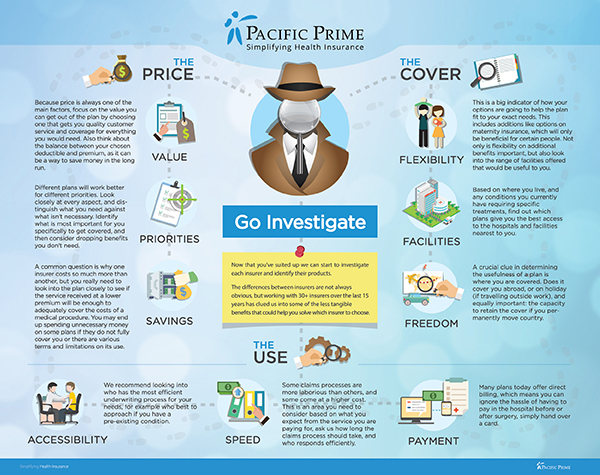

Fortunately for those not in the know, Pacific Prime has created a helpful infographic to assist with precisely this problem, which is available for free here. This infographic covers a number of things to keep in mind when searching for a health insurance plan, and we will expound on some of the major points here.

Price

Let’s face it, what people in Singapore are often focusing on when they are shopping for just about anything, health insurance plans included, is the bottom line. Much like any other purchase we make, we all start out shopping with a ballpark figure in mind of what we want to spend, and perhaps the first feature of an insurance plan we’re tempted to look at is the price tag.

For expats in Singapore, this can be especially valuable, as they are comparing the cost of their health insurance premiums vs. the cost of paying for healthcare at the city’s private hospitals and clinics, as people new to Singapore will likely not have access to the city-state’s public healthcare system.

Nevertheless, there can be a certain amount of wide eyed stares from people when they see some of the prices that today’s health insurance plans may present them. Keep in mind, however, when using online comparison tools like the one found on Pacific Prime Singapore’s website, that the prices shown in the results will cover a wide range of premiums and benefits.

Here’s an example:

If you have a quick look at the above image, you will notice premiums ranging from S$24 a month to as high as S$197 a month. So what is the reason for this spread? The two primary culprits are:

- The plans shown feature different deductibles as standard: While adjustable in most cases, you can see how the deductibles shown vary. This is the amount of money that you will have to spend on a claim before the insurer will pay out any benefits.

- There are different levels of coverage shown: The checks and exes above show the different coverages included, and you can see a very wide spread among the annual limits of the various policies, from anywhere between 50,000 and 3.9 million US dollars annually. The more coverages included and the higher the annual limit, the higher the premiums of a plan will generally be.

From the above you can see that what is initially presented to you is not actually the full story. There is still more research to be done to make sure you know exactly what you will be getting for the price paid. Look at the deductible, the annual limit, the coverage included, and other features of the plans, such as exclusions and specific conditions covered.

What to get covered

There are essentially three basic levels of cover that are offered by most insurers:

- Inpatient: This is the most essential form of insurance coverage. It will only apply to serious emergency conditions that are likely to require you to spend a significant amount of time in a hospital.

- Inpatient + Outpatient: The same overnight hospital stays offered by inpatient only coverage, but with a whole host of other smaller conditions included. This includes small surgeries and normal doctor’s office visits, among many other items.

- Inpatient + Outpatient + Maternity: All of the cover mentioned above, but also includes maternity insurance for those people that will want to expand their families in the future. This type of cover comes with a lengthy waiting period, so obtaining it early is key. This type of plan can also be known as a full coverage plan.

Again, there are the basic health insurance plans offered. In actuality, all of these plans are further broken down into much more specific sets of benefits and coverages. Additionally, riders for other types of medical needs like dental and vision plans can be purchased separately or added onto these basic plans for an additional charge as riders. Fortunately, Pacific Prime Singapore’s online tool allows you to tweak the coverages you want so that you can find the right balance between all of these elements and find a price that works for you.

Think about what you want to get from health insurance plans

Before you go and make your final decision to purchase a plan, you will want to have a think about how you and your family will actually be using it. Does a person on your plan have a pre-existing chronic condition? This is a critical consideration, as some insurers and plans will not cover any pre-existing conditions. Other health insurance plans, however, will cover them for a higher premium or loading. They may even cover it fully without additional charge if it can be demonstrated the condition has been absent for a set length of time, usually several years.

Another thing to consider is how much you value your time versus the service that an insurer provides. Does the insurer offer direct billing with the medical facilities that you’re most likely to use? If not, you will have to spend time filling out claims forms and waiting for reimbursement in many cases. Does the company have online systems that will allow you to more easily have access to your health insurance info, as well as communicate with the insurer directly? Questions like this may be hard to answer without significant research, but when you’re comparing a dozen or more insurers, who has time for it?

That’s why working with a broker like Pacific Prime Singapore can be such a value. Not only can a knowledgeable insurance advisor take your specific details and present you with health insurance plans that are most suited to them, they can also give you the inside information on the insurance companies themselves that may not be readily apparent normally, whether good or bad.

To find out more about how Pacific Prime Singapore can help you, as well as to get free plan comparisons and price quotations, feel free to contact us today!

- LASIK in Singapore - July 21, 2023

- Fighting Childhood Obesity in Singapore: Healthy School Meals and Tips - July 12, 2023

- Understanding Hospital Room Rates in Singapore - June 6, 2023

Comments

Comments for this post are closed.